Consumer Strength

Crypto Market Week in Review (17 February 2023)

Markets

This week stocks slightly advanced and bond prices declined, reacting to the strong US macro data. Better-than-expected US retail sales indicated that consumer spending remained well-supported. The all-important US inflation data was hotter than the consensus forecast, leading to repricing rates higher and bond prices lower. US inflation probably peaked, but its decline is frustratingly slow. Stocks were more resilient than bonds, likely because the economy seems strong enough to tolerate slightly higher rates.

US Core CPI (%)

We note an interesting article about Chinese individuals, often using cheap consumer loans to invest or speculate instead of spending. Bloomberg reported how easy and cheap it is to get a large consumer loan in China now. “To qualify, he just submitted a form of basic personal information on his bank’s mobile app and paid a visit to a physical counter for an identity check. Hours later he was notified with a text message that he’d been cleared for the loans, with the money arriving in his account a few minutes later.” – Bloomberg said about 300,000 (about $44,000) yuan consumer loan, typically carrying an interest rate below 4%. Many borrowers invest in local stocks or pay mortgages, but we think that some may choose crypto or other assets too. Chinese demand stimulated by too-cheap consumer loans may become a significant tailwind both for global liquidity and crypto prices this year.

Cryptocurrencies rallied this week, mostly reflecting negative sentiment about possible regulatory actions. Both Bitcoin and Ethereum jumped by 10%. Bitcoin touched $25000 at the week’s high, but after that corrected below $24000.

The US regulator (the New York Department of Financial Services) ordered Paxos to stop issuing new Binance stablecoins (BUSD). The amount in circulation is not affected, but the company cannot mint new coins. That had surprisingly little effect on crypto, as Bitcoin was only slightly down on the news and started a big rally the following day.

The implied volatility of Bitcoin rose since the last Friday and reached the highest level since February 3. Bitcoin volatility curve became upward sloping, suggesting some normalization after this week’s big move.

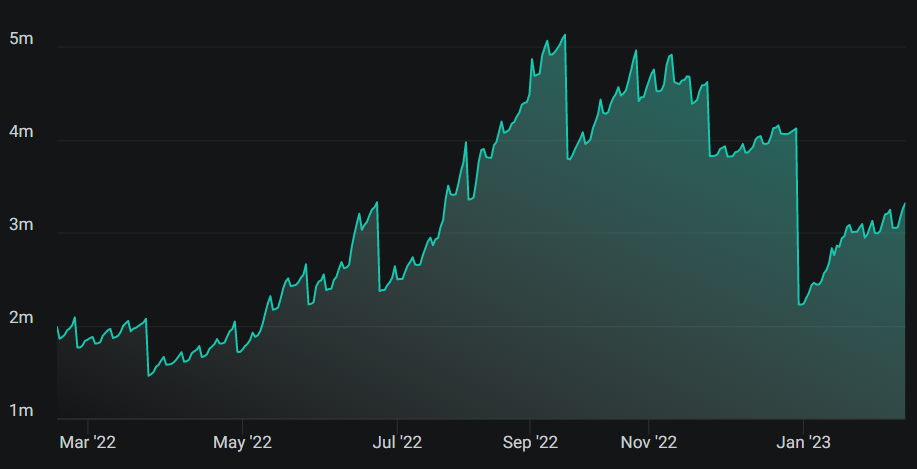

Ethereum implied volatility advanced too, but the magnitude of the increase was smaller. Ethereum options' open interest has not recovered back to December levels despite the upcoming Shanghai upgrade.

Ethereum Options Open Interest

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.