Half of Asia's Investors Have Crypto Exposure

Crypto Market Week in Review (10 June 2022)

Market

After an unsuccessful attempt to break the $32,000 mark, Bitcoin is back at the $30,000 level. While it might sound like a boring week, we’ve observed some interesting on-chain data that could suggest where the markets will trade next.

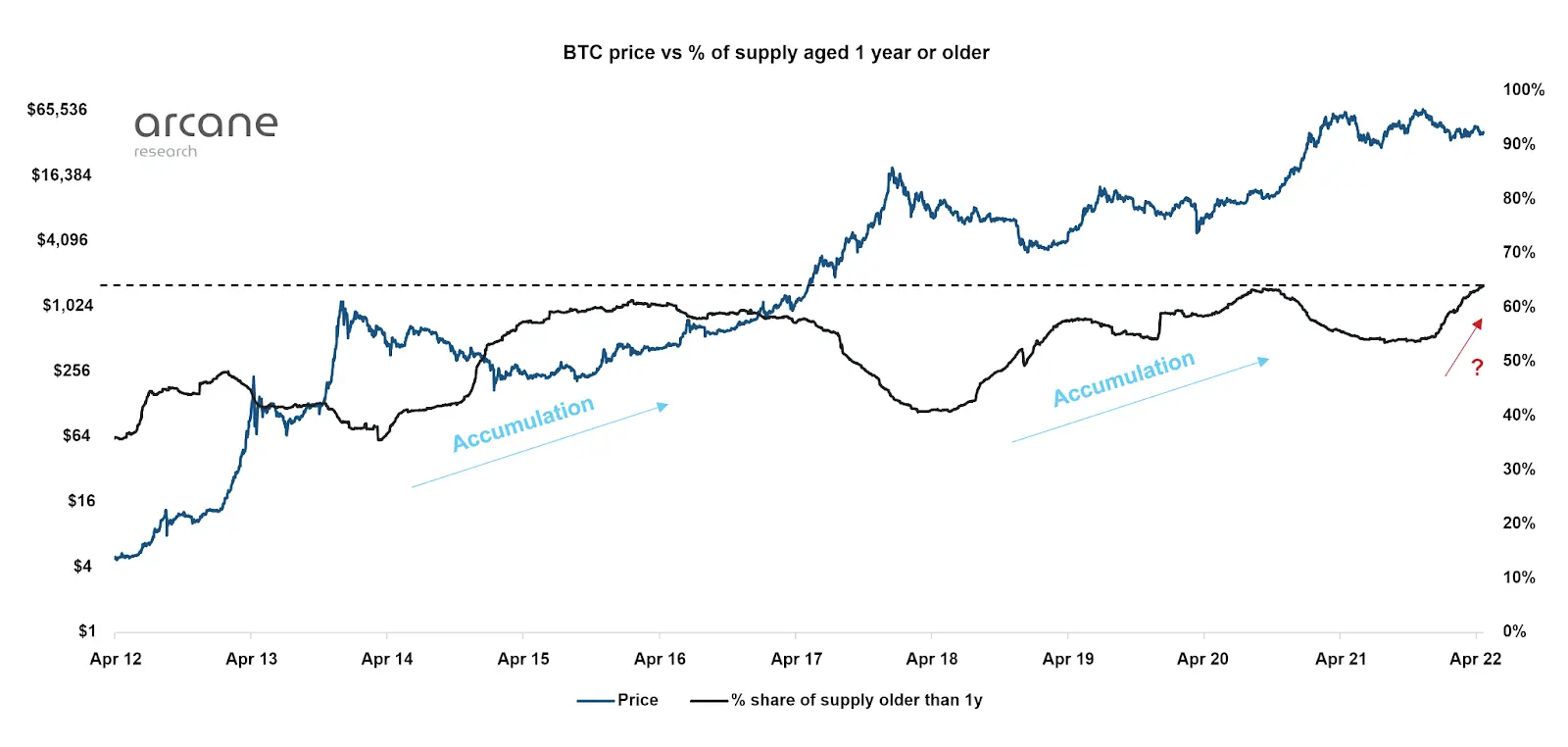

First, the percentage of BTC that has not moved in a year increased to 64%, showing positive signs of accumulation. This percentage was at 54% in October 2021.

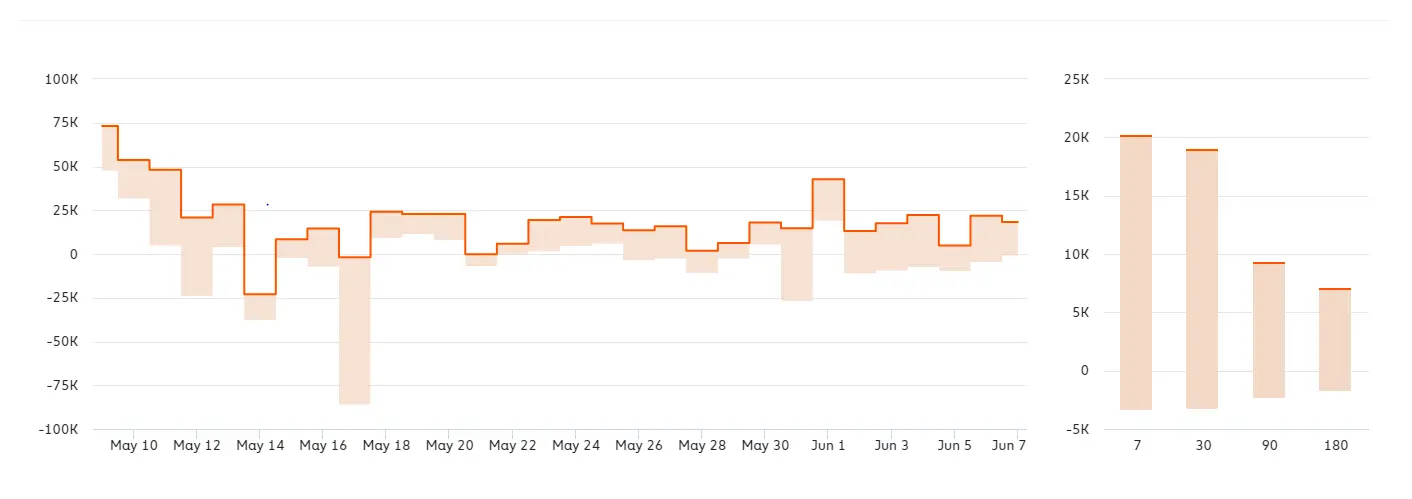

Also, a Chainalysis chart showed that the BTC held on exchanges increased over the last seven days. The current figure is at 18.35k BTC, more than double its 180-day average.

This week, the World Bank lowered its prediction for economic growth this year from 4.1% to 2.9%, citing risks of stagflation. Cryptos have suffered against this backdrop, as well as looming uncertainties in the space, including the Terra fiasco, regulatory ambiguity, and protocol issues.

In the Altcoin market, Ethereum’s Ropsten proof-of-work chain was successfully merged with the proof-of-stake beacon chain. Although Vitalik Buterin played down the success by saying, "I mean, of course, the merge working well for 6 hours isn’t evidence of complete success, there are still longer-term issues," it is clear that the mainnet merger is one step closer.

A surprise guest in this week’s market recap is Litecoin. The last time Litecoin was in the headlines was when it was the target of a hoax press release announcing a Walmart relationship. However, it just made headlines again. Major Korean exchanges are delisting Litecoin's LTC token because of privacy advancements involving the MimbleWimble protocol, which aims to make transactions anonymous and untraceable.

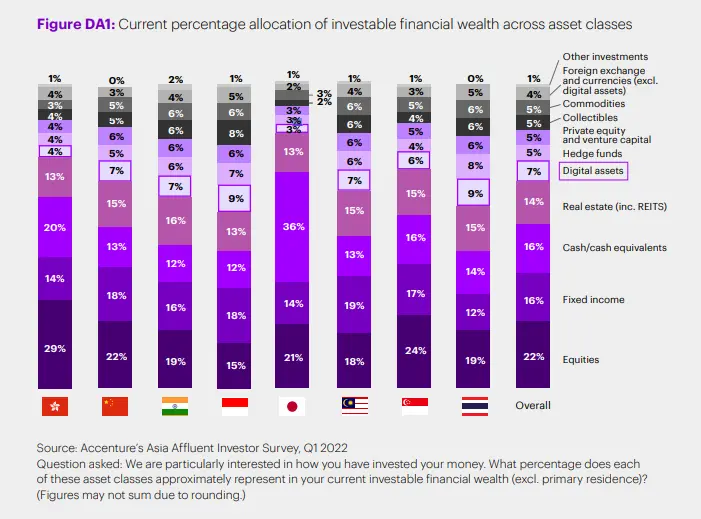

Report Says Half of Asia's Affluent Investors Have Crypto in Their Portfolio

In a Monday report released by Accenture, more than half of Asia’s wealthy investors have crypto exposure. Digital assets, such as cryptocurrencies, stablecoins, and crypto ETFs, account for 7% of their portfolios. This figure is more than many invested in commodities, venture capital funds, and foreign currencies.

The report, titled “The future of Asia wealth Management,” saw Accenture survey 3,200 Asians with a net worth of between $100,000 and $1 million and 500 wealth management firms. Most investors have over one wealth manager, and the primary wealth manager is chosen based on the robustness of their advice offering.

Although 52% of investors have exposure to cryptocurrencies in their portfolio, a whopping 67% of wealth management firms don’t and have no plans to offer digital asset advisory services. They cited a complex crypto economy and a lack of understanding of how digital assets operate as their major reasons for not offering crypto advisory services.

With this overwhelming proportion of crypto advisors who don’t have an idea of crypto, Accenture deduced these investors are left to get their crypto advice from unreliable sources, most likely through social media.

Thailand and Indonesia were two nations that saw the most crypto exposure in their investors’ portfolios, and the Asian crypto adoption will continue as 21% of the surveyed investors plan to have some crypto exposure before the end of 2022.

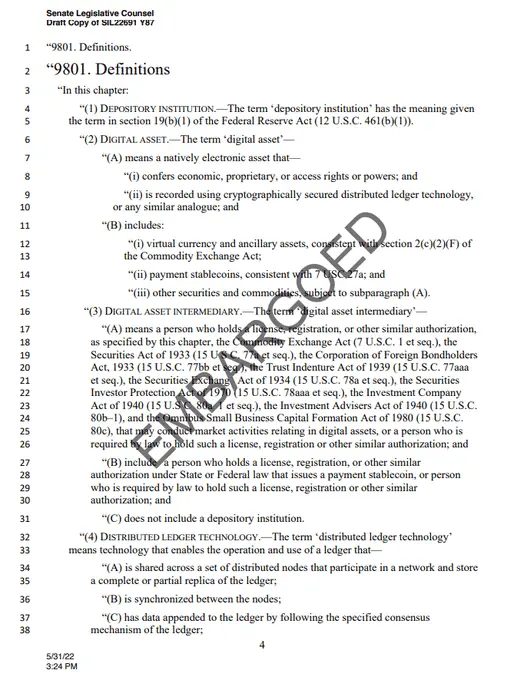

A Leaked Copy of the US Draft Bill Shows DeFi and DAOs under a Regulatory Lens

Crypto Twitter went wild on Thursday after a leaked 600-page copy of a United States draft bill concerning cryptocurrency. Some of the highlighted areas included DeFi, crypto exchanges, and decentralized autonomous organizations (DAOs).

The bill's primary aim is to reduce anonymous transactions and offer user protection in the United States, although it offers a vague overview of what DeFi means. It looks to enforce this by requiring crypto, DeFi, or DAO platforms to register in the US.

Other things stated in the draft bill include more clarity on securities laws relating to digital assets, an increase in exchange compliance costs, which could lead to an increase in exchange fees, and the classification of automated market makers as exchanges.

Another part of the bill states that crypto exchanges cannot liquidate users’ funds in cases of bankruptcy.

Amidst the tension and claims of stricter oversights, it should come as a relief that it is only a draft, facing a backlash from the community.

PayPal Enables the Transfer of Digital Currencies to External Wallets

Two years ago, PayPal rolled out a new feature, enabling users to trade cryptocurrencies, followed by the plans for its own stablecoin, the Paypal coin, in January.

The company is making headlines again. This time, PayPal allows users to transfer digital assets with external wallets. There are not too many supported coins, and only a few users in the US will test run this feature before it is open to the entire country.

Apart from external crypto transfers, customers with crypto in their PayPal wallets can spend them at many merchant terminals across the US. Paypal to Paypal crypto transfers will be free, but transfers outside PayPal will incur a network fee, depending on the blockchain.

New Japanese Law May Allow the Seizure of Stolen Crypto

Reports from Japan show that Japan’s Justice Ministry is allegedly considering revising the Act on Punishment of Organized Crimes and Control of Proceeds of Crime (1999). This revision will see cryptocurrencies classified as assets that could be seized if found to be stolen or laundered.

Currently, only physical assets, moveable assets, and monetary claims fall under the list of assets that can be seized. However, cryptocurrency could be the fourth asset class if the bill goes through the legislative arm of the government, where it is expected to face little to no resistance.

The local media outlet, Yomiuri Shimbun, explained on Sunday that there are still some important details, like how to obtain private keys and if the law will be effective with decentralized exchanges, that need to be resolved before the law goes live.

Another local news outlet, Jiji Press, said the legislative council could receive the bill as early as July 2022.

The crypto space in Japan is also facing new regulations. Last week, the nation’s parliament passed a bill to criminalize stablecoin issuance by non-banking institutions. Only licensed banks, registered money transfer agents, and local trust companies may issue stablecoins.

US Central Bank Digital Currency Commenters Are Divided on Benefits and Unified in Confusion

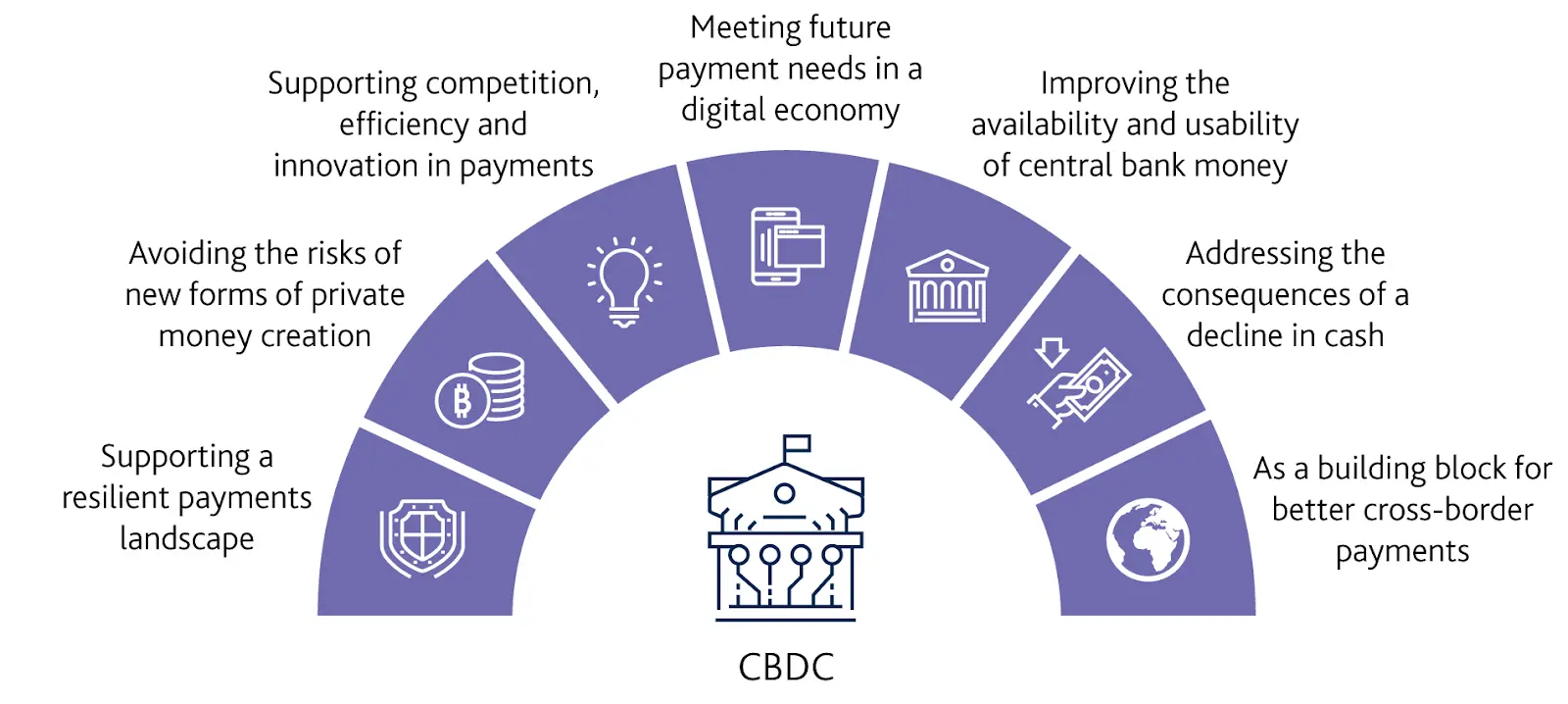

Earlier this year, the United States Federal Reserve Board of Governors released a discussion paper on a potential US central bank digital currency (CBDC).

The paper, which was titled “Money and Payments: The U.S. Dollar in the Age of Digital Transformation.” was open to public comments for five months, ending May 20, and over 2,000 comments were received from individuals and stakeholders.

Most of the stakeholders' public responses revealed a great division in the perception of different stakeholders on the need for a CBDC.

One stakeholder, the IIF, explained that at least 12 policy considerations must be considered before a CBDC can be launched. Some considerations include environmental issues, technical issues, and the need for the private sector in adopting a CBDC.

Moreover, the real work is with the Fed working alongside banks to know the impact of CBDC on lending processes.

Another stakeholder, the Credit Union National Association, provided a skeptical response. Its main concern is “what problems CBDCs are attempting to tackle that most existing digital payment channels in the US do not address?”.

The American Banking Association also responded to the discussion paper by explaining that launching a CBDC will lead to the movement of funds from banks to the Fed. This would more likely undermine the roles of banks in the financial world.

Simply put, incumbents won’t give up without a fight.

Ropsten Testnet Merge Goes Live!

The Ethereum blockchain took another step toward a long-awaited update, transitioning to a proof-of-stake (PoS) consensus, which will strengthen the platform on all fronts.

In what has been labeled a "dress rehearsal" for the Ethereum blockchain, the Ropsten testnet successfully migrated to PoS. According to the Ethereum Foundation, the next step is the Goerli and Sepolia testnet transition to the PoS before the mainnet transition.

There was great joy amongst community members. Musician Jonathan Mann celebrated the merge by rocking out a Ropsten-merge-themed song. Roberto Nickson, the founder of Metav3rse, described the event as a "huge milestone" and a "historic" event." An Ethereum developer, Parithosh Jayanthi, took to Twitter to appreciate the efforts of those working on the merge.

Although Parithosh said a few fixes needed to be done, he noted the team was on it and would monitor the progress in a few weeks. The news, however, did not seem to affect ETH’s price.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.