Netflix As a Template to Bitcoin Recovery?

It looks like the market starts differentiating between innovation assets. Netflix shares double from lows, while Zoom and many other high-risk tech stocks remain near lows. Can crypto recover like Netflix?

Innovation Assets Are Different

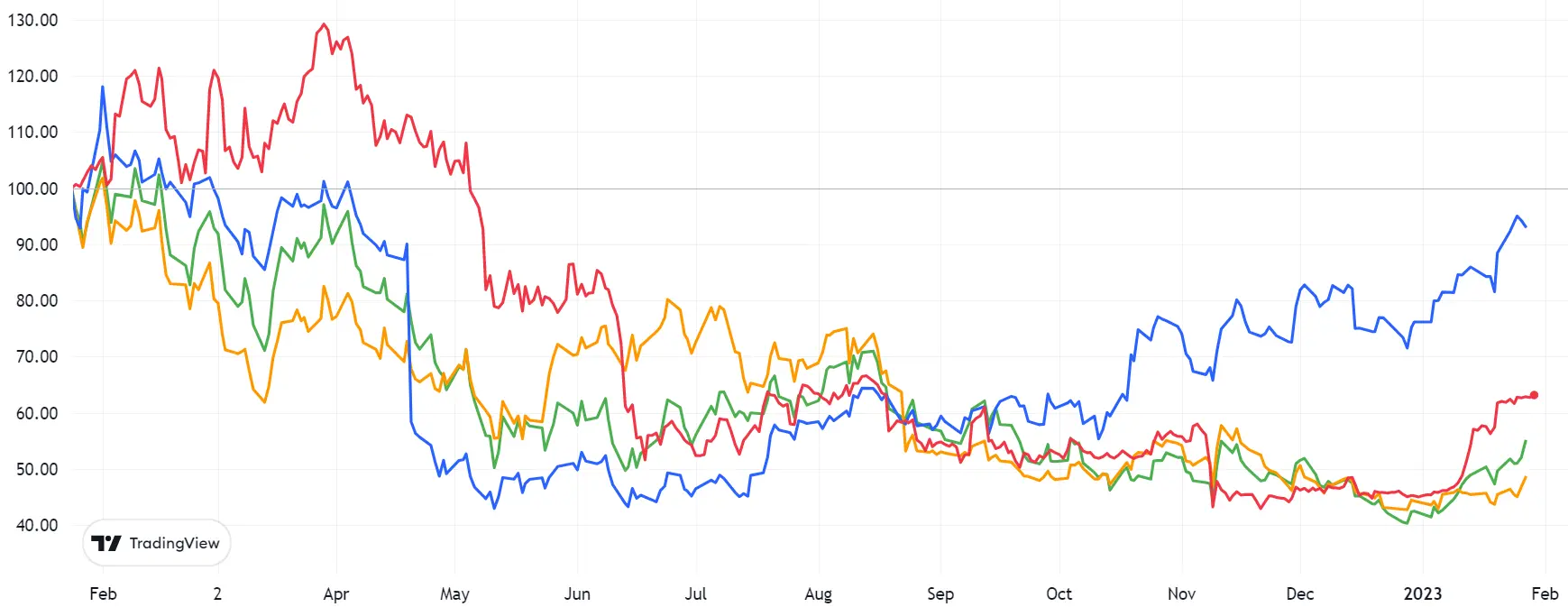

Last year's relentless selling of crypto, high-risk technology stocks, and other innovation assets led to the nearly uniform performance of these assets until last October. In September there was almost no differentiation between innovation assets, as the market focused on the big macro trend of higher real rates and ignored the fundamentals of specific assets. That started to change in the fourth quarter with Netflix stock rallying on company-specific news despite the weak performance of other innovation assets. This year Bitcoin joined Netflix, making an impressive recovery despite many high-risk technology stocks remaining depressed.

1-year Performance of Netflix (blue), Bitcoin (red), ARK Innovation ETF (green), and Zoom (orange)*

* All are indexed at 100 at the period beginning

It looks like the market stopped trading on big macro trends only and starts to differentiate between innovation assets based on their specific factors.

Netflix Story

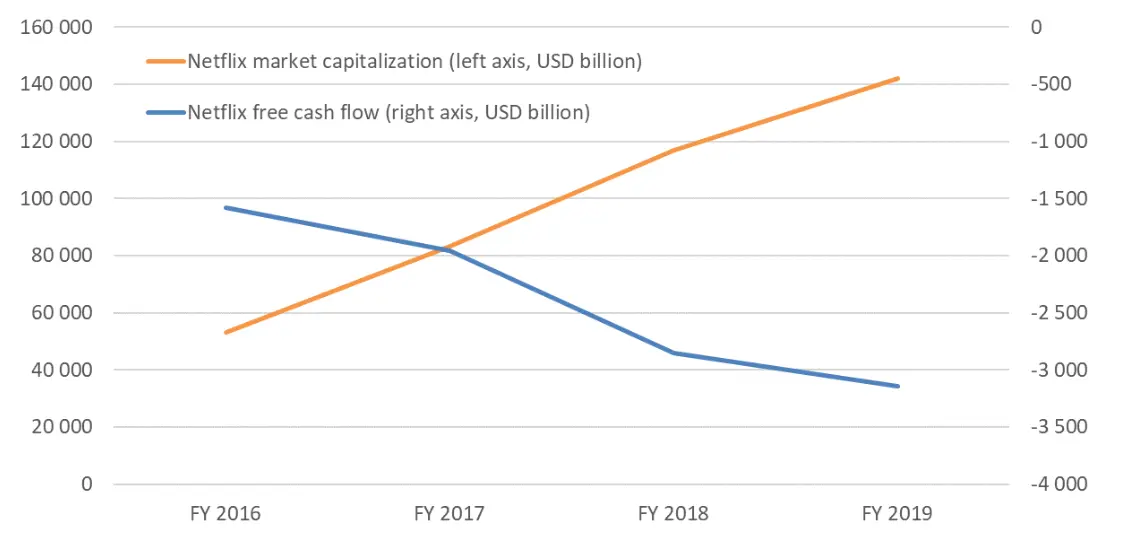

Founded as a DVD-by-mail service in 1997, Netflix pivoted to streaming in 2007 and became a pioneer of a nascent video-on-demand media. In 2013 it decided to focus on original content production instead of just licensing content created by other media companies. The initial success of the original content (particularly House of Cards) and a fear of future content restrictions by other media companies (that eventually turned out a great prediction) convinced Netflix to bet big on its own content. However, large-scale content development required huge costs, which Netflix could not afford to cover with its revenues then. Netflix’s management turned to a risky but brilliant strategy, borrowing big in order to create a lot of its own content and to secure its number one position in streaming. The market liked the strategy, nearly tripling Netflix's market cap in 2016-2019 despite increasingly large negative cash flows.

No Cash Is No Problem

The pandemic quarantine was a boon for the company, as people stuck at home consumed way more video content. Netflix turned to a positive cash flow in its fiscal 2020 year, evolving from a money-losing venture into a solid telecom company. The combination of still-high subscriber growth and increasingly good cash flows made Netflix a true star, sending its stock price to all-time highs in the fourth quarter of 2021.

That changed in 2022. Monetary policy tightening led to much higher real interest rates, forcing the market to focus more on near-term profits than long-term prospects. At the same time, a pandemic boom of stay-at-home services partly reversed, as people freed from quarantines started to spend more on restaurants and traveling rather than on online video. These trends decimated Netflix's share price, which plunged by as much as 71% in the first half of 2022.

5-year Performance of Netflix Stock Price (USD)

The valuation reset, however, put a floor to Netflix's stock price, while the company acted to improve business performance by better monetization of its wide user base. Netflix introduced a lower-priced ad-supported version, which ironically provided more revenue per user than a plain monthly bill (because of revenue from advertisement). Subscriber growth also normalized after excess volatility caused by the pandemic and subsequent reopening. The stock price more than doubled from the summer 2022 lows.

Fundamentals Start to Matter

Netflix has been one of the first (and arguably one of the highest-quality) representatives of high-risk unprofitable technology companies, which became a whole sector made popular by Elon Musk and Cathie Wood (of ARK Invest). Unlike Netflix, most of the companies from this sector so far have failed to make a significant recovery from lows.

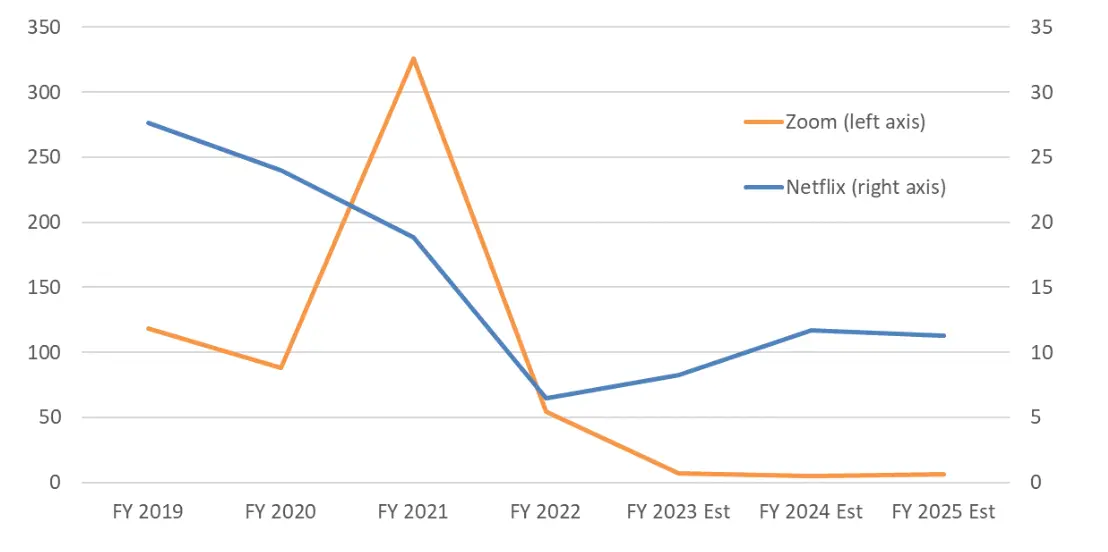

For example, let’s consider Zoom, which is another pandemic winner and one of the largest and most famous representatives of high-risk technology companies. Zoom shares skyrocketed by more than 8 times from the beginning of 2020 to October 2020 high, but completely reversed this rally in 2021-22. Currently, Zoom shares are just 13% above the low reached in December 2022 and well below levels prevailing the last summer.

Performance of Zoom stock price (USD)*

* Since its IPO in April 2019

The depressed share price probably has a fundamental reason. Unlike Netflix, Zoom has failed to maintain a leading competitive position and its growth decelerates sharply with no recovery in sight (or at least the consensus forecast compiled by Bloomberg cannot see it). Microsoft Teams is way more successful vs Zoom than Disney+ and other streaming providers vs Netflix.

Revenue Growth Rates of Zoom and Netflix (%)

I think that Zoom is cheap and will be eventually bought by a large technology company at a nice premium to the current share price. However, I have no doubt that many other high-risk tech companies don’t have a sustainable business model and will not survive during bad times.

Will Crypto Be Like Netflix or Zoom?

Netflix's recovery from lows is largely explained by its strong competitive position and healthy financials many other high-risk tech companies don’t have. The market increasingly focuses on specific factors of innovation assets, rewarding those assets which have the best fundamentals. Thus, it’s time for a crypto to prove its usefulness in order to continue recovering. I think that crypto adoption this year may become more critical than macro factors. Increasing instability of the financial system in a number of emerging market countries and broadening sanctions may provide a tailwind for the wider use of crypto.

I believe that there should be differentiation within crypto too. Cryptocurrencies providing a convenient way of payments and a store of value (like digital gold) will survive and prosper, while crypto assets representing just memes and funny pictures with no practical value may never recover.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.