Dogecoin Explained

In 2009, the world was launched into a new era of currency with the release of Bitcoin. Since then, many other cryptocurrencies have followed suit, each offering its unique twist to the original concept. One such currency is Dogecoin, which was introduced in 2013.

Many people never heard of Dogecoin until 2021, but it is now one of the most popular cryptocurrencies in the world. Dogecoin is a digital currency that uses cryptography to secure its transactions and control the creation of new units.

Dogecoin cryptocurrency has a total supply of 132 billion coins and a current market capitalization of over $7 billion. Here's everything you need to know about this popular cryptocurrency!

A Bit of Background on Dogecoin Cryptocurrency

Bitcoin was a novel idea at the time of its launch, but back in 2009 it was yet to take off as something that would affect the real world. However, in 2010, the now-famous pizza purchase was made, where Lazlo Hanyecz bought two pizzas for 20,000 Bitcoin.

The transaction is widely regarded as the first transaction done with Bitcoin currency. This transaction showed that Bitcoin could be used in the real world as a store and exchange of value. Following Bitcoin was the emergence of other cryptocurrencies, referred to as altcoins.

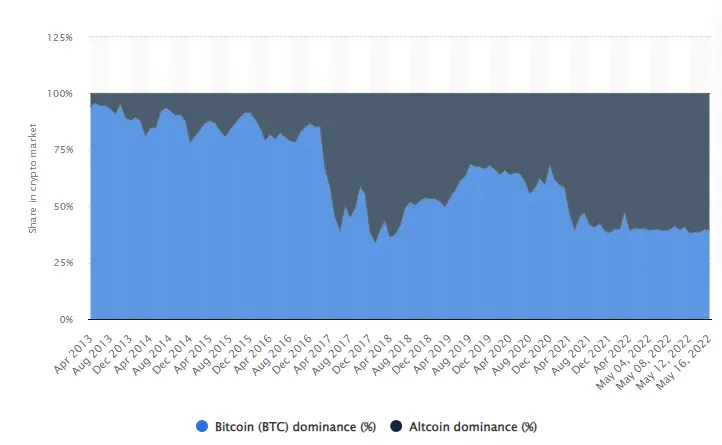

The first of the altcoins, Namecoin, was launched in 2011. Today, there are over 5000 altcoins that have been created since Bitcoin. Dogecoin is one of those altcoins.

Following Bitcoin's breakthrough as the first cryptocurrency, numerous altcoins have performed well, with Ethereum, Tether, USD Coin, Binance Coin, Ripple, Cardano, Solana, and Dogecoin ranking in the top nine. These top altcoins have a summed market capitalization of 472.79 billion compared with Bitcoin's market cap of 557.78 billion. By all fair estimation, altcoins have done pretty well.

The Emergence of the First Meme Coin

Dogecoin cryptocurrency is mostly considered a meme coin among many crypto enthusiasts. The coin was created by two software engineers, Jack Palmer and Billy Marcus, in 2013. At the time of Dogecoin's creation, the coin was a poke at Bitcoin. The logo for the coin was taken from a popular meme. And the name of the coin utilized the misspelling of the word dog for "doge" that was featured in the meme.

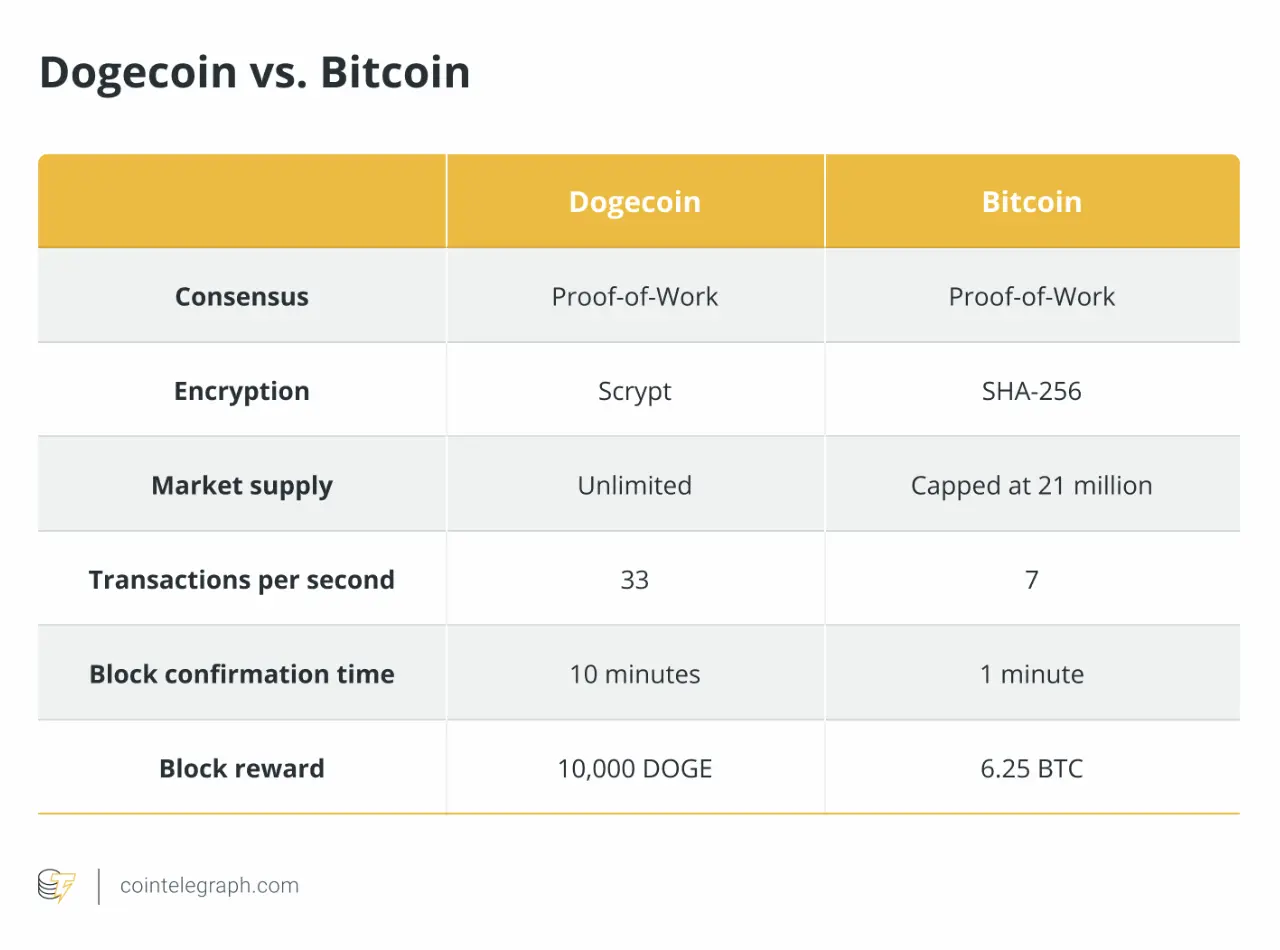

This made Dogecoin the first "meme coin" and "dog coin." Dogecoin was intentionally designed to be somewhat the opposite of Bitcoin. Whereas Bitcoin derives its value from its limited quantity, Dogecoin is the opposite. To put it in numbers, Bitcoin’s supply is capped at 21 million, with just 12.5 units mined every ten minutes. However, with Dogecoin, there are about 130 billion DOGE coins, with 10,000 more mined every ten minutes. The way the coin operates is the joke Dogecoin plays on Bitcoin.

Before its price rally, Dogecoin supporters used the coin for micropayments, like rewarding comments on Reddit, since its value was less than a penny. The Dogecoin community also did some real projects with the digital currency, including helping fund the Jamaican bobsled team to the Sochi Winter Olympics in 2014 and building a well in Kenya.

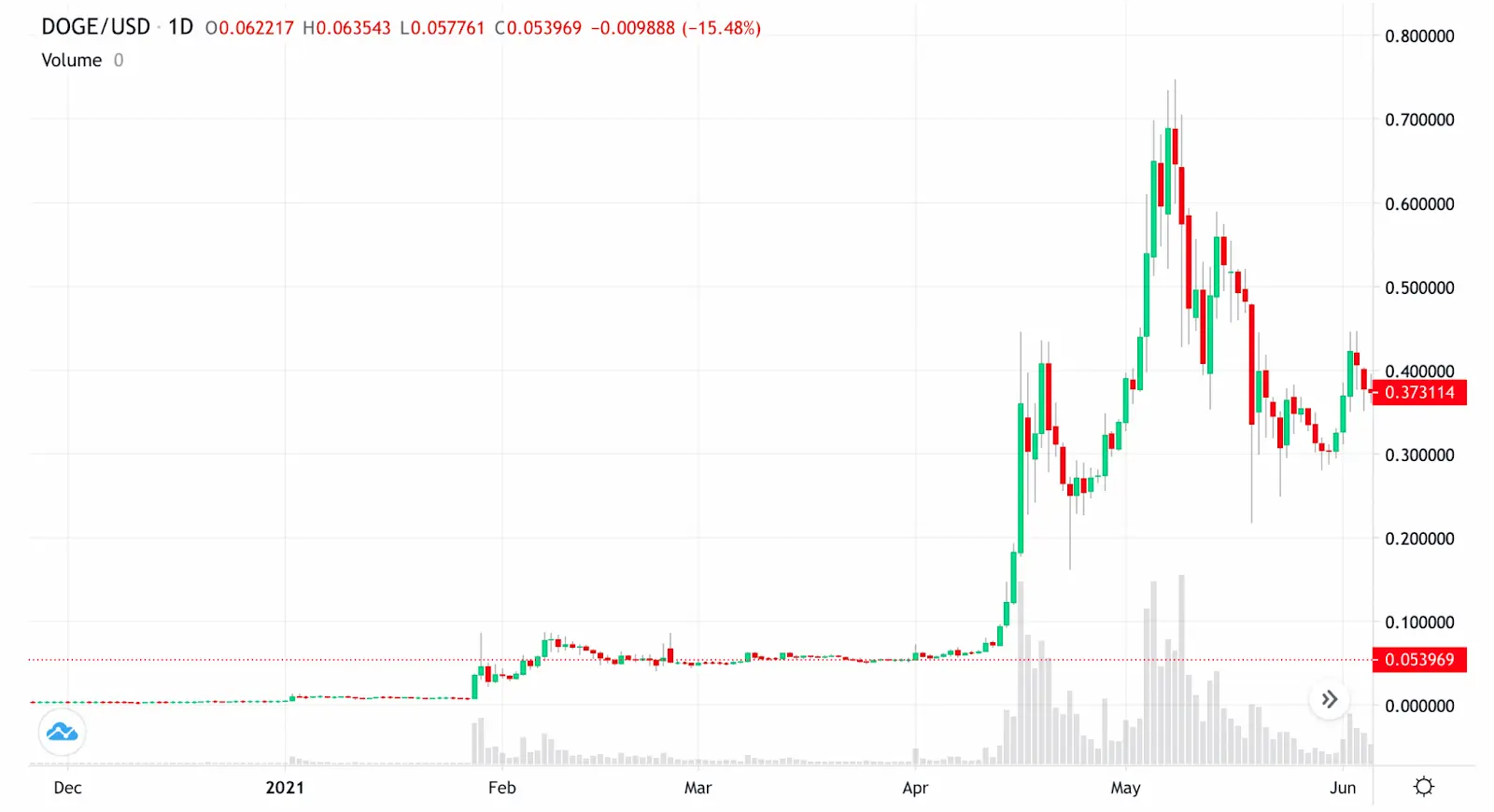

The value of the meme coin shot up in May 2021 when Elon Musk referred to himself as “The Dogefather.” The result was a bullish pattern in the coin's performance, as its value per unit increased from less than a penny to $0.68. Because of its price rally, many new investors followed the hype and started to buy Dogecoin, which drove the price even higher until it attained an all-time high in May 2021.

The success of Dogecoin up to its current position is seen as the result of the social network effect. Dogecoin can be regarded as a phenomenon in the crypto industry, with its unique structure and mode of operation, with the strength of the coin directly coming from its huge supporting community and not necessarily the intrinsic value.

However, the Dogecoin value has dropped far below $0.11 as of May 2022, but despite that, it still ranks among the 10 top crypto coins after Bitcoin.

How Does the "Topdog" Coin Work?

Dogecoin cryptocurrency employs the same technologies as Bitcoin and Litecoin. Like all digital currencies, it is built on blockchain technology. And, like Bitcoin, it uses a proof-of-work mechanism, which means that nodes on the network are constantly verifying transactions and ensuring the integrity of the blockchain.

The following are some characteristics of the Dogecoin cryptocurrency:

- It's intended to be infinite. Cryptocurrencies derive their value from demand and supply; that is, they have a higher value if there is a high demand than what’s available. With Bitcoin, there is a predetermined amount that will ever be mined, whereas Dogecoin has no limit on the amount that can be mined. The reward for adding one block to the DOGE blockchain is 10,000 DOGE. The DOGE that has been mined can subsequently be saved in a DOGE wallet or sold on an exchange.

- Dogecoin is a decentralized cryptocurrency. This means that the power that drives and secures the coin's value is in the hands of the nodes in the network. The Dogecoin network currently contains about 1090 nodes, compared to Bitcoin's 10,000 nodes. This means that the network could be vulnerable to assault since a small number of people control it.

- DOGE is not distributed equitably. According to reports, approximately 0.002 percent of Dogecoin wallets own about two-thirds of the total DOGE supply. As a result, the Dogecoin value is vulnerable to price manipulation by a small minority of holders. The risk or problem here is that the Dogecoin price can easily be exaggerated by the actions of a small portion of its community.

- Dogecoin is abundant because there is no enforced limit on the quantity of DOGE that can ever be mined.

How to Acquire DOGE and What You Could Do with it?

Getting your hands on Dogecoin is the first step. There are different ways to get or buy Dogecoin. However, there are four basic approaches:

- You can verify transactions on the network and be rewarded with DOGE.

- If you have a DOGE wallet, you may also earn interest on DOGE you lend out.

- The third alternative is to trade other currencies for Dogecoin. to buy another cryptocurrency, such as Bitcoin or Ethereum, and then trade it for Dogecoin.

- Some exchanges will also allow you to buy Dogecoin with fiat.

Dogecoin's value is relative to its abundance because scarcity is not a fundamental component of the coin's operations, making it best suited for transactions rather than long-term holdings like Bitcoin, Ethereum, or Binance Coin.

Dogecoin has proven valuable as a financial utility since its birth, and more ways to use DOGE are beginning to surface. You can also trade Dogecoin against news or hold a sizeable amount of the coin, hoping its value will increase as its use cases increase.

What Is the Trajectory for Dogecoin?

Dogecoin's value is expected to rise, according to cryptocurrency observers. This is primarily due to growing currency use and announcements from influential players. Elon Musk's crypto tweets helped Dogecoin to reach its all-time high, and now the biggest story regarding Dogecoin's use puts Elon Musk at the core of it.

Musk announced on May 27th that his space exploration and transportation company, SpaceX, will begin accepting DOGE payments shortly.

This comes after his car company, Tesla, started receiving Dogecoin payments for merchandise in January. After his tweet on May 27th, Dogecoin increased in trades by 4%, outperforming the other major cryptocurrencies that day. A Twitter user also asked Musk if Dogecoin payments for Starlink subscriptions might be possible in the future, to which Musk answered, "Maybe one day."

Dogecoin reached an all-time high in May 2021, when its price increased from $0.004 per coin to $0.7374 per coin. The buzz around the coin fueled its surge. Dogecoin's value has risen in tandem with enthusiasm generated by its community or influencers such as Elon Musk, more than most cryptocurrencies. Even though the coin's performance is expected to be positive in 2023, analysts and investors are concerned about whether and how the excitement can be sustained. Dogecoin's price has plummeted to $0.086 per coin at the time of publication after trying to uphold its hyped growth.

Despite the current price dip, the Dogecoin price is expected to stabilize between $0.0285 and $0.0637 in 2022, with a maximum price of around $0.22. Experts believe that if Dogecoin finds stability between $0.0285 and $0.0637, it will rise for a second stimulus-driven boom to a price of $0.351 in 2023.

The Dogecoin's journey has been one of a vicious cycle of rapid rise and fall, with the meme coin doing well usually in the aftermath of some announcement or tweet from Elon Musk, dubbed the Dogefather. Commentators on Dogecoin's past and future performance agree that the coin must aim for more use cases beyond those offered by Elon Musk if it is to sustain its value. This feeling is shared by the DOGE community, attempting to expand the coin's utility as a digital currency. This would be the best-case scenario for Dogecoin. Worst case scenario is that it loses its relevance as the influx of new cryptocurrencies pushes its price to the point where it can't be revived.

Conclusion

So, is Dogecoin a good cryptocurrency to invest in? There is no one answer to the question since different investors use different approaches and strategies. However, getting into cryptocurrency necessitates taking the proper strategy and conducting your research (DYOR). Dogecoin's prospects appear to be rather positive. However, a few critical elements can either strengthen or undermine the top meme coin's success. Supporting the network by performing dogecoin transactions might be better than keeping DOGE in your wallet if you would like to help DOGE thrive.

*This communication is intended as strictly informational, and nothing herein constitutes an offer or a recommendation to buy, sell, or retain any specific product, security or investment, or to utilise or refrain from utilising any particular service. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. This communication does not constitute and shall under no circumstances be deemed to constitute investment advice. This communication is not intended to constitute a public offering of securities within the meaning of any applicable legislation.